As a mum of two young girls, juggling family life, work and a travelling husband, I’ve been thinking more and more about my own mortality. I know, fun, right?

My walk along the beach was refreshing and awakening and slightly morbid all at the same time…

I recently returned to work and while I enjoy the challenges that work-life brings, it has also opened my eyes to all the other important things that are often forgotten with life as an expat here in Dubai. There’s the usual worries about what if something happens to me while my kids are at school and my husband is out of the country, to the even more concerning, what if I were to get really sick and couldn’t care for them, or worse…..? What if something happened to both of us at the same time?

What can I do to make sure my kids are ok?

So first of all, I learnt that guardianship arrangements and ICE plans (in case of emergency if you hadn’t heard of them) were really important to ensure everyone would know what to do should something happen to me. The ICE plan, is a straightforward document that I could set up easily and provide to my employer, school and friends to ensure everyone knows who to contact in an emergency, meaning the authorities wouldn’t need to get involved and my kids would be ok. Great, that’s one worry sorted! Guardianship on the other hand would be needed in the event of longer-term care and arrangements for my kids, so I need to get legal support on that one!

Discovering CIC (Critical Illness Cover – to you and I!)

I got thinking, what if I was really sick…? I always thought CIC was some kind of new social media challenge to raise awareness for another incurable disease, but no…it stands for Critical Illness Cover. Basically, insurance in case I was to get cancer or a terminal illness and couldn’t work any more or look after my kids without help. I decided to look into this, but at the same time, there’s also the chance that I could die unexpectedly and then what…?

Looking at the options

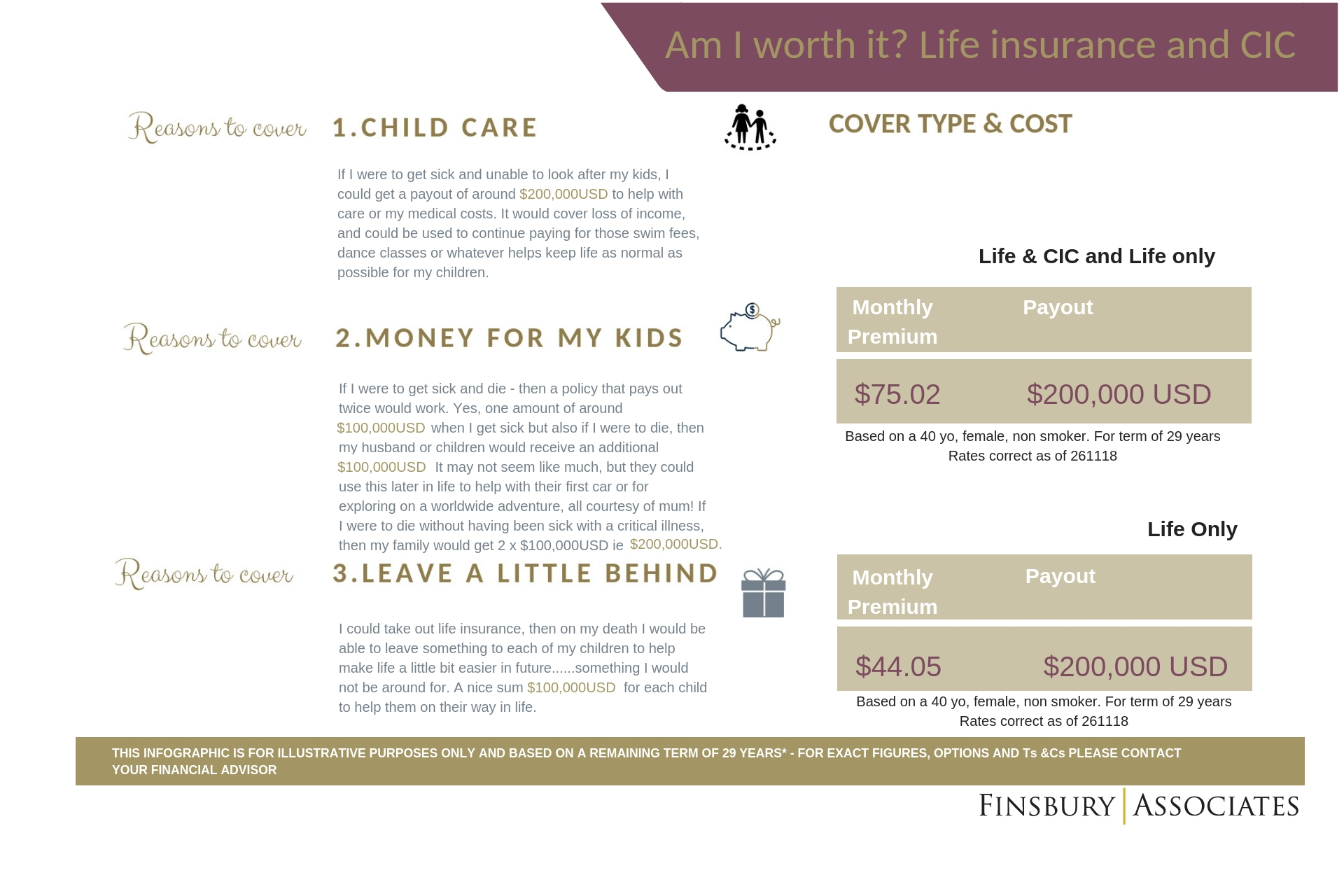

I decided it was high time I took a look at this life insurance thing. Something I thought only the main breadwinner needed and that was an unnecessary cost when there’s swimming fees to pay for, school camps, school shoes and birthday parties! I found there were several options, but I guess I had to work out why I needed cover and how much it would cost me. So I broke it down:

Cost:

I didn’t realise for around $100* a month I could be covered for up to $200,000* in the event of my death or a serious illness. And once it’s paid out, you stop paying the premiums. Or I could even get cover that pays out if I get sick and again if I were to sadly die, leaving my kids a small sum courtesy of mummy.

So while my daily walk felt good, and got me thinking, it did highlight that planning ahead for the future and the unexpected is just as important as considering the planned events. We just never know what’s around the corner. I’m hoping that the beautiful blue ocean and golden sand continue for as long as possible, but for now at least I can feel better that my children will be protected and looked after whatever life throws at us.

For a simplified look at the options for cover and why you might make this decision your next priority, please see the infographic below:

Illustration for typical 40 year old female, non smoker – 29 year term.[/caption]

Illustration for typical 40 year old female, non smoker – 29 year term.[/caption]

*costs are illustrative only, always speak to your advisor for a formal quote based on your circumstances